Agreview

$20.00 inc. GST / month and a $500.00 sign-up fee

Out of stock

Product Description

What’s Agreview about ?

Understanding how the business is performing from a cash perspective, where non -trading sources of funds are accessed and what these funds are spent on, is critical for the successful management of the business. Currently this information, whether it is recorded in the businesses cash book software or taxation financial statements is not easy to identify or interpret.

As a farmer, or an adviser to farmers, people need to have a good concept as to exactly how much cash the business derives, on a year in year out basis, after making allowance for taxation, committed financial outlays , replacement and upgrade of plant and equipment and personal drawings.

In addition to this it is essential that business managers are aware of current and potential financial risks It is only once you know this information that business managers are in a sound position to make financial decisions or for advisers to provide advice on management performance and plans.

The Agreview program produces a range of key financial performance indicators specific to the farm business. As information is added each year it provides invaluable trend analysis in a range of critical financial areas of the business to assist with performance monitoring.

The program is not a generic benchmarking program as such . It is designed to provide information to the business manger about their own business and trends within that business. Used in conjunction with the planning programs Agrequip and Agriplan the Agreview program provides a detailed analysis of the actual financial outcome of those plans and trends within the business .

This feed back and analysis is invaluable when it comes to formulating the next revised plan.

What’s in it for the business ? Why should you as a business manager use a program to tell you this information ?

Currently there is little in the way of informative financial reporting available for farmers.

Traditional taxation financial statements are unsuitable for farm financial analysis. They often incorporate taxation transactions such as delayed income, brought forward expenditure, statutory income and expenses, accelerated capital write offs and are prepared solely to determine the income tax outcome of the business. Further to this livestock natural increase are recorded at unrealistic tax values and there is no effort to incorporate any physical production data.

Other than generic benchmarking programs and simple cash book programs there are no financial reports for farmers to analyse, to determine whether their plans and decisions are successful. As a result many farm businesses are unaware of how they are performing financially or whether the business is subject to current or future financial risk . They only know whether they are successful or not by the level of their bank balance and what they have purchased.

There is no formal financial assessment of past events, plans or financial trends and decisions are not objectively formulated on actual outcomes. Quite a lot of major financial decisions are based on past experience, consultation with family, peers and professionals and gut feel.

Unfortunately the consequences of poor decisions can be catastrophic and can have a significant effect on the long term viability and sustainability of the farm business.

Our program places farmers in the driver’s seat where they can take control of their own destiny.

Having a clear understanding of where the business is positioned and how it has performed in the past places the business manager in a position where they can improve financial management decisions to increase profitability and reduce current and potential financial risks .

Of what benefit is it to Professional advisers ?

Essential knowledge about the farm businesses past performance, current and potential financial and production risks reduces an advisers personal professional risk in relation to the advice they provide.

Once the farmer subscribes to the software application the accountant or adviser can use the software to generate reports and use the planning tools to enhance the services they provide to their client .

Prior to the release of our software accountants and advisers were capable of performing these financial analysis tasks however the exercise could be time consuming and costly and often farmers were unwilling to pay for the service as they saw little value in the exercise.

The software we have developed produces meaningful farm management reports with little effort and time allowing the farmer, their accountant and farm adviser the opportunity to discuss the businesses performance and future plans without the expenses of a costly review.

How does it work ?

Traditional annual financial statement information and production data is entered into the program, it is then dissected, apportioned and processed to reveal the actual flow of cash funds and financial outcomes from a farm business management perspective as opposed to a taxation perspective.

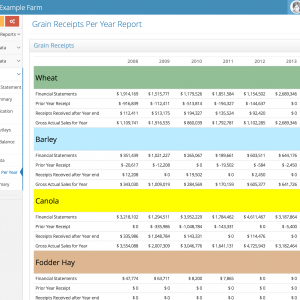

The information is then presented in a range of graphical performance reports specific to the business. Over a period of time these reports provide a trend summary of key businesses performance indicators.We recommend that the reports key performance outcomes, issues and recommendations are discussed annually with the farmers professional advisers. Reports can be printed as PDFs or viewed on line and discussed over the phone if need be.

These reports are farm management profitability reports not farm enterprise orientated reports .

The program is not only an enterprise and operating benchmark program. It is all about the individual businesses cash flow. Where the cash flow profit has come from and where the cash has been used within the business to support and sustain the family and improve equity.

As the years go by farmers are able to track key performance trends and use this information to assist with evaluating the businesses performance over time. Most commercial businesses do this except for primary production businesses.

Experience has shown some farmers can have excellent performance benchmark figures and they can generate sound cash flows from farming, however business is just as much about what you do with that money once it has been earned, as it is about how you earn it.

For instance few people know how much they actually spend on replacement and upgrade of machinery in relation to production and profit, or how much they spend on themselves in relation to the profit they generate. They may think they do, but once they calculate the actual figures it provides a very clear picture of what’s really going on in the business. Traditional financial statements do not clearly outline this information.

It is only once you have conducted an analysis of your business like this , that you can feel comfortable about knowing what is really going on so you can make informed management decisions.